MP Econ Issue 1: Risks to China's growth prospects

How Economic Comorbidity Hampers China’s Growth Prospects

As attention focuses on China’s post-Covid economic recovery, it is worth thinking through what comes after the recovery. Will China return to its growth potential in the near term or will growth lag longer than expected?

When it comes to growth, one concern that keeps me up at night is the weakened state of local government finances. This preexisting condition has only worsened as a result of the pandemic shock and is at the crux of what currently ails China.

To borrow a medical metaphor, China suffers from a case of “economic comorbidity.” Comorbidities are usually more difficult to treat because one condition invariably interacts with another, affecting growth prospects.

So looking out towards the medium term (3-5 years), my base case is one of “multi-speed” growth. That is, about half of China’s regions will experience fiscal difficulties and will have a tougher time fully recovering. As a result, this could drag down China’s overall growth by at least 1 percentage point over the next few years.

Here I will mainly diagnose why local finance woes sit at the heart of economic comorbidity and how that impacts growth. In a future note, I will look at how China might treat these conditions and whether that treatment takes the form of traditional Chinese medicine or Western prescriptions.

Local Governments between a Rock and a Hard Place

In the foreseeable future, many local governments’ finances will remain tenuous at best and continue to deteriorate at worst. This is because they will simultaneously face the double whammy of bleak revenue conditions and the inability to borrow sufficiently.

First on revenue. In recent years, fiscal revenue growth of highly indebted regions has already lagged GDP growth—a trend that will only get worse during this economic contraction. Moreover, what many local governments once counted on for revenue—land sales—will no longer be as reliable a source of income.

Although land sales saw record growth of 11.4% in 2019, that was driven overwhelmingly by the 100 largest cities. So far in 2020, land sales across these cities have resumed positive growth, but remain negative in all other urban markets. But this sales growth will do little to help local governments that are feeling the severest revenue crunch, because the majority of these 100 cities are not in the struggling regions.

Second on borrowing. Under revenue constraints, there are two ways local governments can borrow money: on-budget and off-budget. Economically weaker regions are already at a disadvantage when it comes to on-budget borrowing—the central government allocates the borrowing quota primarily based on the local government’s fiscal health.

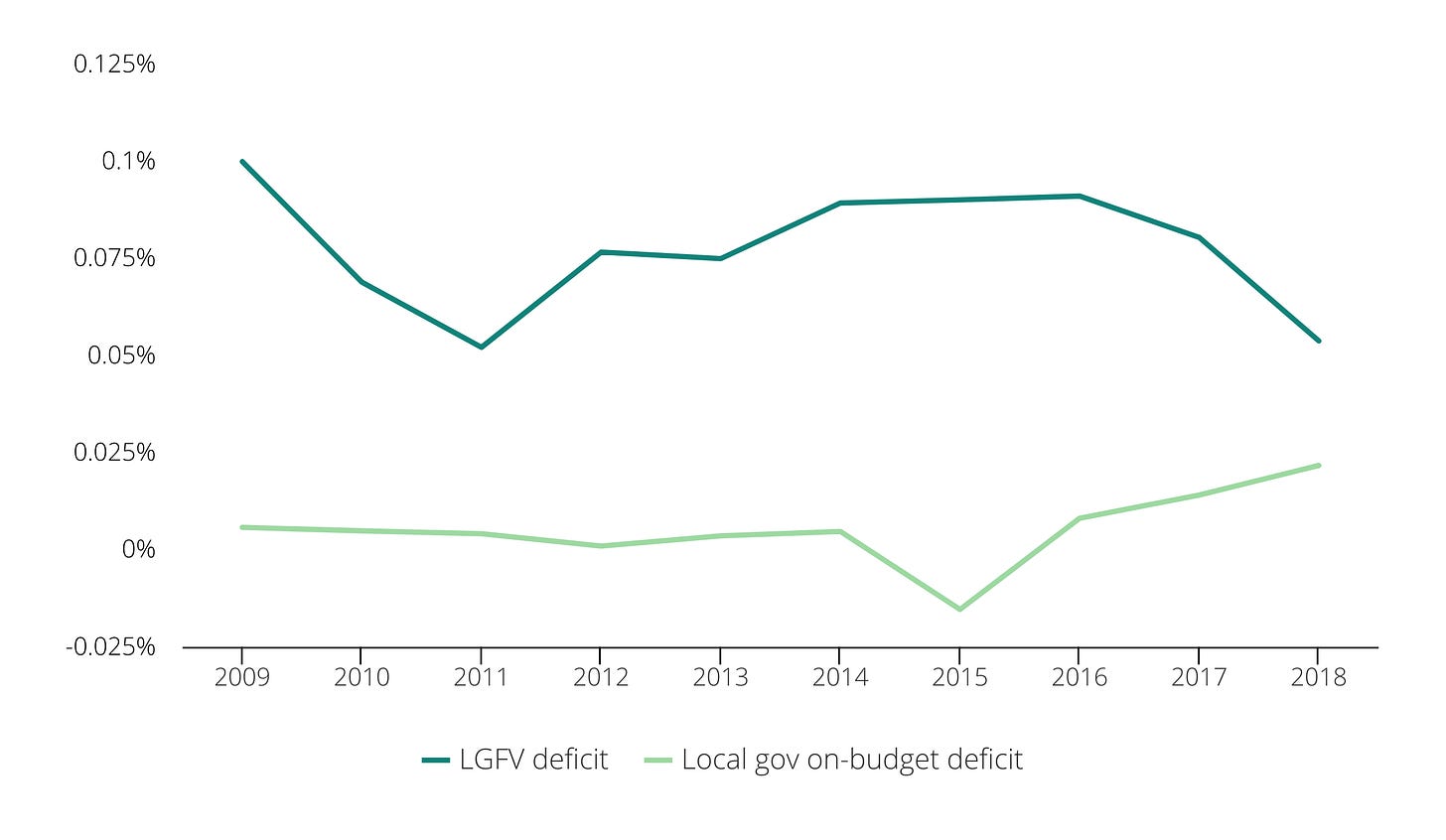

This means regions with high levels of debt will not be able to secure enough on-budget borrowing, forcing them to pursue off-budget borrowing via local government financing vehicles (LGFVs). The LGFVs have been the most important source of financing for local governments over the last decade (see Figure 1).

Figure 1. LGFV Deficit Is Much Larger Than On-Budget Deficit

Note: Both LGFV and local government deficits are expressed as a % of national GDP.

Source: Wind.

Yet even there, local governments are handcuffed. State banks and the central government have been keeping a lid on lending to "riskier" regions with already sizable debt, which have been mainly accumulated by the LGFVs. As a result, LGFV borrowing, similar to land sales, will be concentrated in economically stronger regions rather than the regions that truly need it.

Restricting off-budget borrowing is a bit like pouring salt on the wound of already beleaguered provinces. Based on an analysis of LGFV debt across all regions, I estimate that at least 16 regions with total economic output equal to one-third of national GDP have already seen significant declines in new LGFV borrowing and will likely continue to face difficulties on that front (see Figure 2).

Figure 2. LGFV in Weaker Regions Have Difficulty Borrowing

Note: This shows the share of total LGFV bond issuances going to the the 16 economically weaker regions: Tianjin, Inner Mongolia, Liaoning, Jilin, Heilongjiang, Hubei, Hunan, Chongqing, Guizhou, Yunnan, Jiangxi, Xinjiang, Gansu, Qinghai, Guangxi, and Shaanxi.

Source: Wind and MacroPolo.

Beijing Sitting on the Sidelines

All of this begs the question of why Beijing is less eager to offer support amid the economic slowdown. It’s true that Beijing just announced a 2 trillion yuan ($278 billion) transfer to local governments, but it is also trying hard to shed its reputation as the “bailout” capital.

Beijing is well aware of the inherent moral hazard problem in central-local transfers that distorts incentives, and it won’t turn on the fiscal firehose to blanket local governments with sufficient stimulus.

Although local government spending is projected to rise by 4% of GDP in 2020, compared to spending increases of 10% of GDP in other economies, this bump in spending appears insufficient to the task at hand. What’s more, central government spending growth will remain flat, suggesting that Beijing is expecting local governments to do all the heavy lifting.

Some could argue that Beijing’s fiscal prudence may be the result of “overlearning” the lessons from the 2009 stimulus. That stimulus did leave a trail of debt that the government is still cleaning up, but today’s extraordinary times may demand exceptional measures.

Yet Beijing does not seem persuaded, even as half of China’s regions appear to be on the fiscal ropes. Time and again, the central government has learned the lesson of “if you give an inch, they will take a mile” when it comes to local government spending.

If local governments have any expectation of bailouts, Beijing believes the cycle of irrational exuberance and misallocation of funds won’t be far behind. That would undermine its years-long effort at containing local debt instead of prioritizing a temporary growth boost. For Beijing, this no longer seems to pass its cost-benefit test, which is why it has insisted that the “central and local government dine separately, rather than share the meal.”

Economic Comorbidity Will Stifle Growth

The pandemic hit a Chinese economy that already had a weakened immune system in the form of shaky local finances. This preexisting condition is central to amplifying the symptoms of economic comorbidity, chiefly manifest in the private sector.

First, regions in poorer fiscal health will have to make hard choices of how to allocate limited resources. Despite Beijing’s insistence on prioritizing support for the private sector, especially small and medium-size enterprises (SMEs), local governments will nonetheless prioritize rescuing struggling LGFVs.

From the local governments’ standpoint, not saving LGFVs would erode their credibility as guarantors of these vehicles’ solvency. Letting one LGFV collapse would likely lead to a domino effect of investors losing confidence in all LGFVs in that region.

What’s more, Beijing will probably be more practical in dealing with SMEs than meets the eye. This can be seen from the central government’s willingness to raise the unemployment target by 0.5 percentage points, which implies that Beijing is expecting a certain level of private business bankruptcies that would lead to higher unemployment.

Second, SMEs in weaker regions will be more starved of the credit they need. That’s because creditors overwhelmingly prefer lending to fiscally sound regions, as that is correlated with the local government’s ability to bail out businesses (see Figure 3). The second- and third-order effects of this comorbidity on investment, hiring, and consumer confidence is fairly clear, and I’ve detailed them in my quarterly outlook.

Figure 3. Credit Disproportionately Flows to Stronger Regions

Note: This shows the share of credit going to the 16 economically weaker regions: Tianjin, Inner Mongolia, Liaoning, Jilin, Heilongjiang, Hubei, Hunan, Chongqing, Guizhou, Yunnan, Jiangxi, Xinjiang, Gansu, Qinghai, Guangxi, and Shaanxi.

Source: Wind.

Reforms to the Rescue?

Based on all signs thus far, Beijing appears prepared to leave the weaker regions to their own devices. This may reduce the moral hazard problem and keep debt in check, but it also means the recovery process will be much slower and less holistic.

Moreover, China and other major economies, including the United States, will have to end their accommodative policies at some point. Based on the post-Global Financial Crisis experience, exiting the accommodative phase tends to lead to a second dip in growth. For China’s already fiscally fragile regions, responding to these disruptions will prove exceedingly difficult without Beijing’s intervention. Internationally, this also means that China’s ability to shore up weakness in the global economy will be compromised.

So the 16 regions’ growth prospects may come to resemble that of Spain over the last decade. Without adequate stimulus, it took almost a decade for Spain’s GDP to recover to its 2008 level. The divergent fortune of these weaker regions relative to the fiscally sound ones will also exacerbate regional inequality.

The next 3-5 years will likely not be particularly bullish for aggregate growth as China gradually treats its ailments. But that doesn’t mean the future is all gloomy either. Just look at the Asian Financial Crisis in 1997. That shock shaved off an average of 3% growth over the 1997-2002 period. At that time, the Chinese economy also exhibited symptoms of comorbidity, including a legion of insolvent state firms and skyrocketing nonperforming loans.

But China eventually recovered by the early 2000s on the back of reforms and headed into one of the most bullish growth periods in recent history. Those far-reaching reforms to the state, banking, and housing sectors may not have boosted near-term growth, but they were the bitter medicine China needed to put the economy on sounder footing.

This time, too, Beijing has rolled out a series of reforms that, if implemented fully, could also have significant consequences. They won’t matter much for immediate growth, but with the right follow-through, particularly on the market allocation of input factors, China can regain its growth mojo in the long run. I will explore these issues and the 14th Five-Year Plan in future notes.

Houze Song is a research fellow at MacroPolo. You can find his work on the economy, local finance, and other topics here

The Paulson Institute is a non-partisan, independent, privately funded “think and do tank” not supported by or connected to any government.